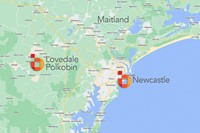

Newcastle, Pokolbin & Lovedale, NSW

DA approved development sites and rural land

The Loan is secured by first registered mortgage over two (2) large development sites located within the Newcastle CBD and four (4) properties in Pokolbin and Lovedale within the Lower Hunter Valley, north of Sydney and a short distance from Cessnock.

The Newcastle Properties are made up of two (2) DA approved development sites comprising 4,099m2 and 4,597m2 of 'MU1 Mixed Use' zoned land, respectively. The 4,099m2 site has DA approval for the development of an 8 storey hotel and conference centre with 113 above ground car spaces. The 4,597m2 site has DA approval for an educational facility being part change of use for existing improvements. The capital works for this approval are mostly complete.

Both Newcastle properties adjoin the Honeysuckle redevelopment area and are opposite a large multi-storey apartment building and the four-star hotel complex known as Rydges Newcastle.

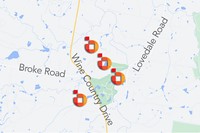

In addition to the Newcastle properties, the Hunter Valley properties are made up of four (4) individually titled properties comprising a parcel of partially cleared and vegetated land, a winery with dam, an older style residence and a 19 room motel.

The Borrower Group is one of Australia's largest privately owned hotel groups. The director has substantial experience in commercial property investment and development, with multiple properties and hotels across Australia.

The Borrower Group is well known to the Manager who has provided multiple loans to the Group. All facilities have been conducted in a prompt and punctual manner.

- The Loan was advanced at a Loan to Value Ratio of 49%.

- The Target Return is 9.05% p.a., net of fees and expenses, and is paid to Investors monthly in arrears.

- The Loan is supported by multiple joint and several guarantees and a General Security Agreement over the Borrower and related corporate entities.

- Interest for the Term of the Loan has been lodged on deposit with the Manager.

- The Manager has assessed the financial position of the Borrower and Guarantors as part of its credit approval process and is satisfied that they are financially capable to service (pay interest) a loan of this nature.

- The Loan Term is 12 months, subject to early or late repayment, from 22 September 2023 to 21 September 2024.

Investment Details

-

Target Return

9.05% net -

Loan to Value Ratio

49% -

Term

4 Months

Full details, unique to each investment, are provided to Investors in a Supplementary PDS. These detailed Supplementary PDS’s are only available to Investors in Balmain Private.

Start now by investing in an individual loan to commence building your own first mortgage investment portfolio with Balmain Private.